The fresh poor case situation is you try not to display whatsoever with your bank and the renovations are not completed, Levitt states. In such a case, the bank get apply your own remaining renovation money on financing dominating and you may eliminate their renovation fund.

Then your balance in your mortgage might be down, nevertheless will not have the money readily available for continued the fresh new solutions.

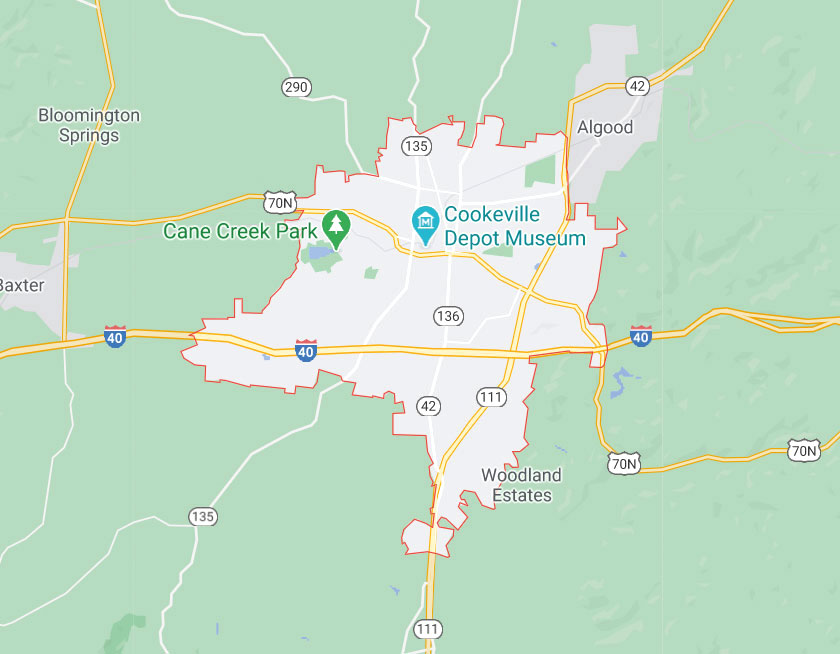

USDA repair fund are great possibilities while you are prepared for the fresh pressures of purchasing a good fixer-higher and you will pick a loan provider close by one to now offers them.

If the bank also provides USDA recovery financing, you should ensure that you’re ready to accept this new realities out-of to invest in a fixer-upper.

Renovating can definitely generate property feel like property, because you reach buy the the new accessories, color, enhancements, or other alter. But renovations try tough, specifically if you plan to inhabit your house whenever you are work has been done.

Much can take place for the procedure, too. Should your contractor bails otherwise also provide can cost you rise, you’ll have to find another providers to complete new functions otherwise manage to protection those costs.

As the contractors are in particularly high demand now, you might have to wait-awhile before the renovations might even begin.

With a USDA get financing, simultaneously, it’s not necessary to publication a contractor or submit a bid to make sure that the mortgage to close. The loan processes is more straightforward, and you don’t need to care about located in a houses zone.

If the residence is a while dated or even the performs requisite is not urgent, you can believe to invest in that have a timeless USDA mortgage and you may renovating later. Once you’ve founded particular guarantee home, you need a money-away refinance, household guarantee mortgage, otherwise domestic collateral line of credit (HELOC) to invest in updates and you will solutions after that. This package also offers an opportunity to get acquainted with our home and really considercarefully what you should do in it.

A USDA renovation financing also offers investment the acquisition and you may solutions in one loan. But you need to go after solutions, tone, fixtures, or any other facts just before you’ve spent much time towards assets.

To put it briefly, you to definitely isn’t necessarily much better than another. Both keeps their pros and cons, however, a good USDA buy financing is easier and quick getting the fresh new homebuyer.

Options in order to USDA renovation fund

- FHA 203k restoration funds

- Virtual assistant recovery financing

- Federal national mortgage association HomeStyle old-fashioned renovation financing

- Freddie Mac Options Renovation

You may also buy a great fixer-upper with a vintage purchase financing and borrow secured on your property equity afterwards to fund home improvements. Otherwise, you can purchase rates for the performs after you have finalized for the our home and you can save to pay bucks to your home improvements.

A hack toward hardy homebuyer

USDA restoration money can help you rating a toes throughout the doorway of one’s homebuying industry from the skipping the brand new putting in a bid wars and you may this new escalating costs on the brand-new or even more well-maintained property. However, they’re not to your faint from center.

If you find yourself prepared to carry out the legwork to find a company, and you are Ok to the first couple of days of homeownership becoming about home improvements, an effective USDA renovation mortgage can be good for your.

But when you do not have the big date, energy, otherwise lifestyle independence to own a restoration, that is Ok, also. A great USDA get financing is a great option for to invest in with 0% off. Just in case you do not be eligible loan places Kim CO for a great USDA home loan, you will find some almost every other no and you can reduced-advance payment choices.