When you have an FHA financing, you’re eligible to another loss minimization strategy to help you prevent a foreclosures. Nevertheless the foreclosures itself is no some other.

Within the late , this new You.S. Department of Homes and Urban Innovation (HUD)revealed when the loan is FHA-insured , you can also request a first COVID-19 forbearance through to the COVID-19 Federal Disaster ends up. (In earlier times, the option discover good COVID-19 forbearance are set-to expire towards .)

For those who have a mortgage loan your Government Housing Government (FHA) provides and you are unpaid during the money, or you are about to fall behind, you happen to be permitted a specific losings mitigation way to make it easier to avoid a foreclosure. The latest U.S. Service off Housing and Metropolitan Development (HUD) demands mortgage servicers to attempt to stop foreclosures on the FHA-supported lenders by using the process demonstrated briefly below.

Actually, servicers should be hands-on from inside the obtaining individuals getting losses minimization and you can have to make affirmative jobs to cure a loan standard. But when you can not work-out an approach to the financial delinquency, new foreclosures will go send less than condition rules-like any other foreclosure.

Just how FHA Funds Works

FHA will bring mortgage insurance coverage so you’re able to accepted loan providers, which offer FHA-backed (insured) mortgages to individuals. Lenders provide FHA finance so you can individuals just who or even may not qualify for a mortgage as financing are less risky so you’re able to the lending company. FHA will cover brand new loss if the debtor defaults.

FHA Mortgage Terms

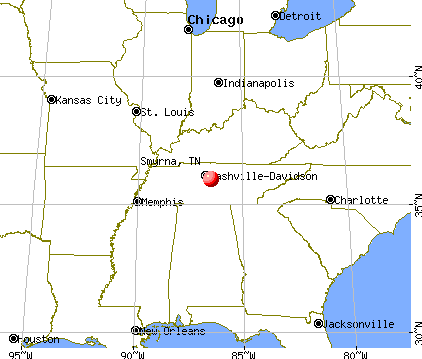

FHA loan providers could offer borrowers good conditions together with the lowest off payment-as low as step three.5% of price. These mortgage can be simpler to be eligible for than a traditional mortgage and you will you can now implement. Borrowers which have an loans Guin AL excellent FICO credit score as little as around five hundred would be qualified to receive a keen FHA loan. However, FHA loans features a max financing maximum one varies dependent for the average cost of housing for the confirmed part.

Consumers Need to pay MIP

Having an enthusiastic FHA mortgage, individuals have to pay MIP (mortgage insurance premium) as part of the mortgage. (Conventional mortgage loans has actually PMI, while FHA loans features MIP.) The newest superior one to borrowers pay subscribe to the fresh Common Mortgage Insurance policies Money. FHA pulls from this fund to invest lenders’ claims when individuals default.

Unique Foreclosures Protections to possess Consumers That have FHA-Insured Money

Because FHA will likely generate losses if you avoid and also make your home loan repayments, the fresh company has created something to simply help people stop foreclosures. Under HUD coverage (FHA falls under HUD), usually, the new servicer need to comment a debtor who may have a keen FHA-covered financing which will be about from inside the payments, or just around to fall about, getting losings mitigation selection. The newest servicer has to measure the borrower having fun with a process called good “waterfall,” that is some methods, to decide hence, if any, of your solutions here are suitable.

How Waterfall Processes Work

When you look at the waterfall procedure, the new servicer must measure the debtor to own losses minimization options within the a specific order, as soon as a borrower is deemed eligible for a particular solution, brand new testing comes to an end. The process pertains to an intricate string out-of computations to choose hence alternative, or no, is actually most suitable on the borrower.

Waterfall possibilities and you may concern. Under the waterfall, new servicer evaluates if or not a borrower is eligible for one out of another solutions (generally throughout the following the purchase):

- forbearance (casual, specialized, or a new forbearance)

- payment plan

- mortgage loan modification

- limited claim (a no-attract, next home loan payable in order to HUD you to brings the loan most recent and you may comes due on the first-mortgage are reduced)

- loan modification together with limited allege

- pre-foreclosure profit (short product sales), otherwise

- deed in lieu of property foreclosure. (Learn more about losses minimization alternatives for homeowners having FHA fund in the Assist to have People Having FHA Finance.)

Government rules will bring time for the loss minimization processes ahead of a property foreclosure can begin. Under federal laws, really property owners, together with individuals with FHA fund, score 120 days to attempt to work out an alternative to foreclosure before the foreclosures will start. However if you’re not able to work out among alternatives a lot more than or any other loss mitigation option, the fresh new foreclosure can start.

Property foreclosure of FHA Financing

FHA mortgage foreclosures are usually similar to foreclosures from almost every other form of money. The process is set from the state laws. Thus, you’ll get any kind of property foreclosure sees your loan bargain and you will state legislation need.

Providing Help

If you like let discussing the loan servicer, need addiitional information on different methods to prevent foreclosures, otherwise are searching for here is how to fight a property foreclosure, imagine talking to a property foreclosure attorney. If you’re unable to pay for a lawyer, a good HUD-acknowledged housing specialist is another useful resource of data.