credit history examiner

the financing get examiner allows you to assess your credit rating report and cibil score. its an effective around three-thumb numeric expression one to stands for your creditworthiness.

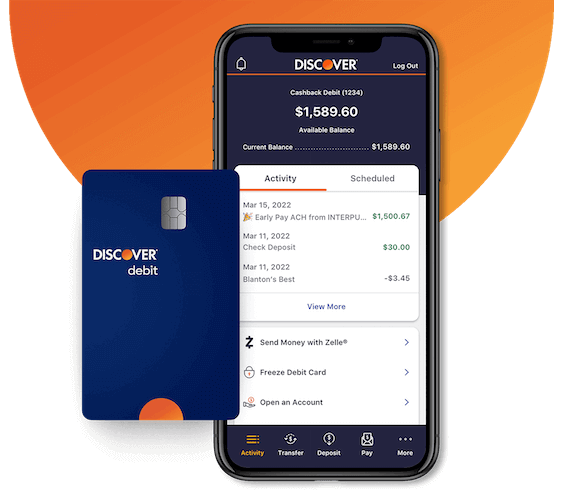

if you’re planning in order to consult a charge card, https://elitecashadvance.com/payday-loans-ca/windsor/ then it is demanded to have your cibil score end up being within minimum 750. looking at the historical past of credit of your candidate is an essential an element of the testing processes.

a credit rating is actually a statistical image of one’s creditworthiness. it will help into the researching your capability to blow back the total amount you may have borrowed. somebody’s credit score constantly ranges away from 300-900, therefore the you to definitely on the higher rating is recognized as being a trusting applicant. always make an effort to reach the higher in the variety as it becomes very useful during trying to get that loan or credit cards. whereas, when you yourself have the lowest score or you fall in all the way down diversity that it screens youre a reckless loan applicant and also have not provided timely repayments of your money/dues.

here is the reasonable CIBIL rating range. it shows that you have defer your mastercard costs payments or financing EMIs and you’re on a high-chance of turning into a great defaulter.

although this CIBIL rating assortment is generally accepted as fair, it signifies that you’ve been struggling to spend the money for expenses punctually.

this CIBIL rating signifies that you really have a good credit score behavior. you really have a leading likelihood of taking a charge card or financing approval. although not, you might still maybe not get the very best interest rate if you’re applying for a loan.

CIBIL get more than 750 represents excellent and you can suggests that your possess consistently paid back your expenses on time and then have an impressive fee history. since you are within low danger of turning out to be good defaulter, loan providers provides you with loans without difficulty and at straight down rates.

- personal information

- credit score duration

- new credit

- amounts owed

- borrowing merge

just why is it vital that you look after a good credit score?

improves your qualifications to possess money: good credit improves their qualification to get a loan less. good credit implies that you pay the fresh expenses or a fantastic count timely you to definitely renders a feeling of yours into the financial institutions and other creditors for which you enjoys taken out that loan.

smaller mortgage approvals: people with a decent credit rating and you may enough time credit score are offered pre-recognized funds. moreover, the loan which you have applied for will get acknowledged easily and you can processing date are no.

down rate of interest: with a decent credit score, you can enjoy the advantage of less interest rate toward amount borrowed that you have removed.

credit cards with attractive gurus- you are considering handmade cards having glamorous positives and you will benefits when the you have got a healthy and balanced credit score.

large credit card constraints: good credit just becomes you the best from credit cards which have attractive pros or all the way down rate of interest towards the mortgage you’ve got taken out but also youre eligible so you can get a high loan amount. a good credit score means that you are equipped to handle the financing regarding the best styles, therefore, finance companies otherwise creditors tend to consider offering you a credit card which have a high limitation.

what are the products which can be felt to own calculating credit rating?

credit history background: credit rating portrays the capacity of mortgage candidate whether or not he/this woman is guilty of paying the bills or otherwise not. it’s got the information of your level of membership which you hold, borrowing from the bank need info and you can facts about put off otherwise failed payments.

credit history questions: borrowing concerns through the advice including the sort of financing whom provides asked about, the level of mortgage you’ve got taken out and you will whether you are just one applicant or a combined applicant.

just how is the credit score determined?

a credit history try computed differently of the certain borrowing pointers bureaus. standard affairs on the basis of which your credit rating try determined try stated below:

fee record – 35% of your credit rating are determined based on your own payment records. your own payment background shows exactly how timely you’ve made new payments, how often you’ve overlooked for the payments otherwise just how many those days the newest due date you reduced your bills. in order to score high for those who have a high proportion away from with the-time costs. be sure to never overlook money because manage get-off a negative influence on your own score.

exactly how much you borrowed from – regarding the 31% of your credit score is determined by just how much you owe for the finance and you will credit cards. when you have a top equilibrium and then have attained brand new maximum of your own charge card after that this should produce a fall in your credit rating. if you find yourself short stability and you will timely costs do aid in raising the rating.

credit history size – the duration of your credit history try accountable for fifteen% of your credit score. if for example the reputation for to the-date repayments are enough time following naturally you might have a high credit history. in contrast, will eventually, you need to get a charge card otherwise mortgage in the place of to avoid they so that you also provide a credit history getting banks’ comment.

how many activities you have – the products (particular loans) you have is in charge of this new ten% of your own credit rating. which have a variety of individuals products like installment fund, home loans, and you will handmade cards aid in increasing your credit score.

borrowing interest – kept ten% hinges on your own present borrowing from the bank situations. credit passion boasts every piece of information away from beginning or applying for some levels, repayment history, form of finance you’ve got applied for and you may credit limit use.

what is actually a good credit score?

a credit rating are an indication from creditworthiness that’s always 3-digit numeric. it selections away from three hundred so you’re able to 900 and certainly will easily be computed having fun with a credit rating checker. a credit history of 680 or a lot more than is recognized as being good get. loan providers have confidence in the financing rating just before giving that loan. of course, if a man can be applied for a loan, loan providers view –

- CIBIL statement and you will score

- a position position

- account details

in the event the borrower or borrower is not able to pay your debt on account of any impairment or a lengthy-title issue, the credit health insurance protects this new debtor.

why you should care for a good credit score?

a credit history means new creditworthiness of people. it’s always an effective step three-thumb numeric you to definitely ranges out of three hundred so you’re able to 900.